Real Property Strategic Advisory

I work as an independent management advisor, part of a program consulting offering or in fractional management roles, with the following mandates:

Management Advisory – works with executives and leadership teams to bring critical situational assessment to uncover risk, opportunities and develop clarity on addressing turnaround, realignment and transformation challenges.

Strategic Leadership – defines, develops and steers complex real property planning and transformation

Independent Real Property Strategy Expert – works with teams to provoke professional robustness and reliability of decisions

I provide management advisory and management services, I do not provide financial or investment advice. I advise and help organizations scope the services to bring on specialized Financial, Real Estate, Project Management, AEC Consulting, Construction Management, Procurement and Change Management services as required.

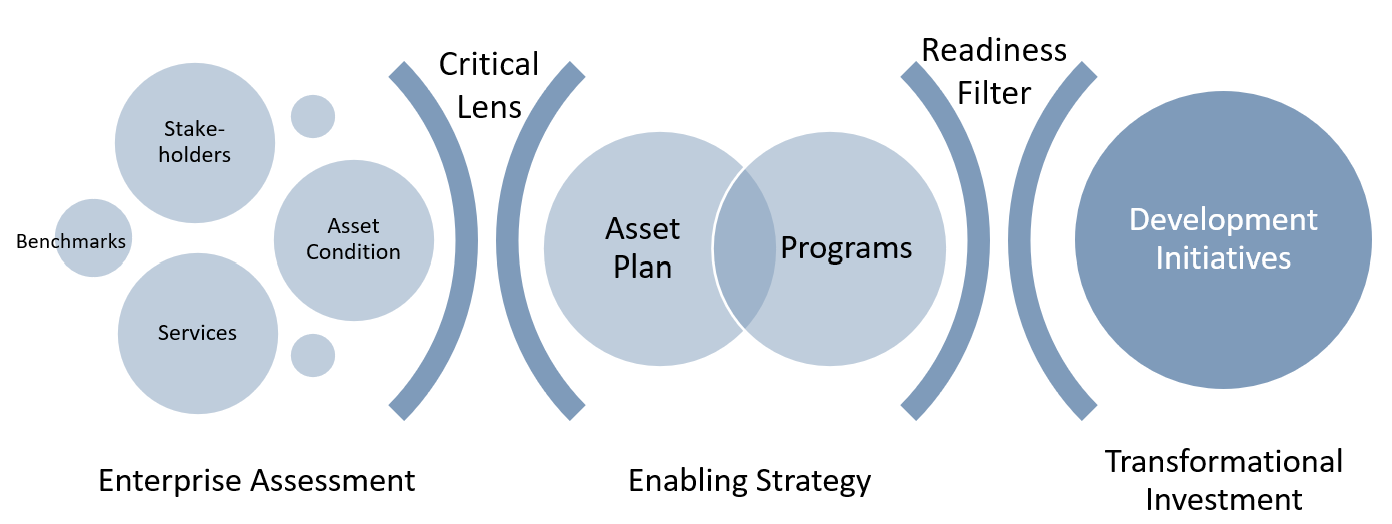

Strategic Transformation Framework

In best practice asset management, transformation is driven from the foundation of clearly enabling organizational outcomes. Credible asset strategies that enable and support business programs and core values, need to be vetted though the critical lens of economics, the environment and the organization’s network ecosystems. Likewise, strategy resilience is demonstrated though adaptive readiness and understanding capability to successfully support transformation.

Consulting Streams

Strategic Portfolio Assessments

CHALLENGE:

Struggling to reconcile lagging asset management to organizational objectives

I listen critically and see across the broad landscape of concerns and influences. I bring adept critical investigation and experienced management insights to understand issues and focus strategically

OUTCOME:

Assessment of assets and management plan identifies critical gaps and opportunities to align with business priorities

Struggling to reconcile lagging asset management to organizational objectives

I listen critically and see across the broad landscape of concerns and influences. I bring adept critical investigation and experienced management insights to understand issues and focus strategically

OUTCOME:

Assessment of assets and management plan identifies critical gaps and opportunities to align with business priorities

Asset Management Strategies & Capital Planning

CHALLENGE:

Organizations need asset portfolios that realistically and dynamically fully support business now and anticipate the future

I bring critical facilitation and experienced oversight to the multi-disciplinary planning process, to ensure the form, elements and context of a portfolio strategy realistically and appropriately align to enable clear direction and outcomes.

OUTCOME:

Developed portfolio strategies and master plans to align capabilities and performance to organization’s objectives over time, with enabling capital strategies

Organizations need asset portfolios that realistically and dynamically fully support business now and anticipate the future

I bring critical facilitation and experienced oversight to the multi-disciplinary planning process, to ensure the form, elements and context of a portfolio strategy realistically and appropriately align to enable clear direction and outcomes.

OUTCOME:

Developed portfolio strategies and master plans to align capabilities and performance to organization’s objectives over time, with enabling capital strategies

Transformation Strategy

CHALLENGE:

Increased and effective investment is needed but needs to be aligned to financial realities and execution readiness. Stakeholders need to be aligned for full support

I provoke creative solutioning to advance a clear intent. I help assess and bring expertise in enabling organizations to navigate advancement, mobilization and business stakeholders’ alignment with strategic clarity and precision.

OUTCOME:

Articulated needs for investment and investment outcomes, led integrated business case development including stakeholder engagement, procurement options and investment impact options

Increased and effective investment is needed but needs to be aligned to financial realities and execution readiness. Stakeholders need to be aligned for full support

I provoke creative solutioning to advance a clear intent. I help assess and bring expertise in enabling organizations to navigate advancement, mobilization and business stakeholders’ alignment with strategic clarity and precision.

OUTCOME:

Articulated needs for investment and investment outcomes, led integrated business case development including stakeholder engagement, procurement options and investment impact options

Transition Capability and Enablement

CHALLENGE:

Organizations need to have fully capable execution readiness to enable and sustain transformation.

As a critical and experienced perspective in building an organization’s teams, capabilties and decision supports, I bring structural clarity and support to resourcing alignments including scope, accountability, risk management and deal negotiation.

OUTCOME:

Identified internal & external capabilities and resources needed to implement solutions, including procurement options, accountability priorities and governance structures

Organizations need to have fully capable execution readiness to enable and sustain transformation.

As a critical and experienced perspective in building an organization’s teams, capabilties and decision supports, I bring structural clarity and support to resourcing alignments including scope, accountability, risk management and deal negotiation.

OUTCOME:

Identified internal & external capabilities and resources needed to implement solutions, including procurement options, accountability priorities and governance structures

Portfolios Characteristics:

• Social-enterprise-oriented

• Community integrated assets

• Large complex and distributed multi-class real property

• Complex multi-level funding and investment profiles

• Publicly accountable outcomes with strong ESG visibility

• Imminent acceleration of growth and program realignment needs

• Community integrated assets

• Large complex and distributed multi-class real property

• Complex multi-level funding and investment profiles

• Publicly accountable outcomes with strong ESG visibility

• Imminent acceleration of growth and program realignment needs

Areas of Expertise:

o Enterprise Real Property (RP) Asset Strategy

o Facility Management (FM) Capability Development and Performance Turn-around

o Integrated Enterprise Decision Support & Governance

o Facility Asset Management Transformation

o Capital Development Strategy and Capital Planning

o Real Property Asset Management

o Strategic Master Planning

o Major Redevelopment Planning and Approval Management

o Public Sector Stakeholder Engagement and Mobilization

o Health Facilities Design Strategy and Standardization

o Provincial Government Capital Approvals

o Capital Business Case Development for Portfolio Transformation

o Real Estate Program mobilization

o Facilities Assessment and Performance Frameworks

o Facilities risk management strategies

o Roadmaps for Master Portfolio Planning

o Public Sector for Real Estate Partnerships

o FM Vendor relationship management

o Facility Management (FM) Capability Development and Performance Turn-around

o Integrated Enterprise Decision Support & Governance

o Facility Asset Management Transformation

o Capital Development Strategy and Capital Planning

o Real Property Asset Management

o Strategic Master Planning

o Major Redevelopment Planning and Approval Management

o Public Sector Stakeholder Engagement and Mobilization

o Health Facilities Design Strategy and Standardization

o Provincial Government Capital Approvals

o Capital Business Case Development for Portfolio Transformation

o Real Estate Program mobilization

o Facilities Assessment and Performance Frameworks

o Facilities risk management strategies

o Roadmaps for Master Portfolio Planning

o Public Sector for Real Estate Partnerships

o FM Vendor relationship management